China’s Economic Growth 2024: Facing Challenges, Its Global Echoes, and Impact

Dr Farhad Reyazat London School of Banking and Finance

3rd of April 2024

Citation: Reyazat, F. (2024, April 3). China’s Economic Growth 2024: Facing Challenges, Its Global Echoes, and Impact. Dr. Farhad Reyazat. https://www.reyazat.com/2024/04/03/chinas-economic-growth-2024-facing-challenges-its-global-echoes-and-impact/

Introduction

In 2024, China, the world’s second-largest economy, sets sights on an ambitious growth target amidst a landscape with substantial hurdles. At the heart of these challenges lies the property sector, a critical but struggling component of the economy. This analysis delves into the intricate dynamics of China’s economic strategy, highlighting the efforts to surmount property market woes and the broader implications for its growth ambitions.

1. Setting Growth Targets Amidst Economic Headwinds

- Aiming for Sustainable Expansion: The 5% Goal

During the National People’s Congress’s annual session, China set a target for real GDP growth of around 5% for 2024. This objective underscores a commitment to maintaining economic vitality in adversity.

- The Property Sector Puzzle

Central to achieving this growth is the resolution of the property market’s challenges:

– Demand Dynamics: A significant slump in new housing demand has negatively impacted sales and construction, challenging the market’s stability.

– Debt Dilemma: High debt levels among developers and local governments pose a twin challenge: reducing indebtedness without derailing growth.

– Deflationary Trends: Wider economic pressures, such as deflation, compound these issues and affect consumer and business spending.

2. Economic Projections and Property Market Insights

- Fitch Ratings Weighs In

March’s Global Economic Outlook from Fitch Ratings places China’s 2024 growth at an adjusted 4.5%. This cautious revision reflects the enduring hurdles within the property sector and beyond.

- Reevaluating the Housing Market

With a forecasted 5%-10% drop in new home sales, Fitch signals a critical need for policy intervention to reinvigorate housing demand.

3. The Interplay of Infrastructure and Economic Resilience

- Assessing Economic Vulnerabilities

– Property Market Strain: Ongoing troubles within the property sphere threaten economic stability, particularly in construction and related sectors.

– Regional Investment Variances: While certain areas might boost infrastructure spending, regions burdened by high debt face spending cuts, underscoring the necessity for balanced, strategic investments.

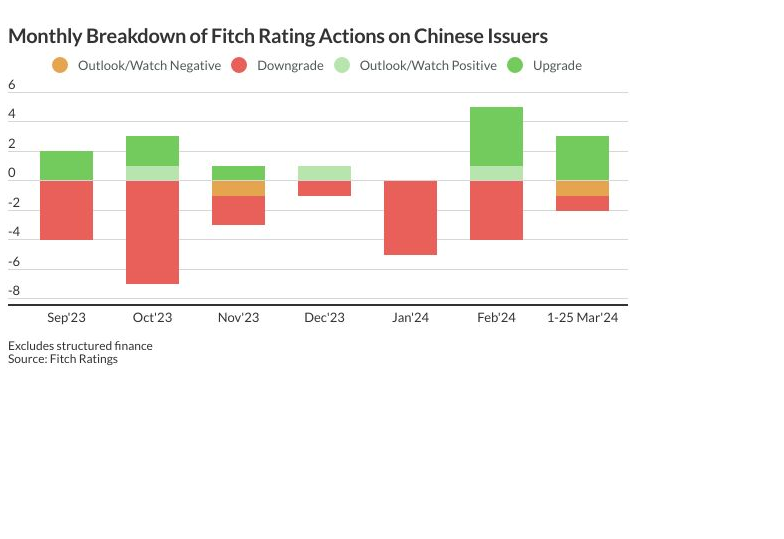

4. Financial Ratings and Real Estate Realities

- Evaluating Corporate Health

March 2024 saw Fitch taking varied rating actions on its China portfolio, reflecting the nuanced impact of government policies and market conditions. China Vanke Co., Ltd.’s downgrade exemplifies the property market’s acute stress, even affecting prominent state-supported developers.

5. Striking a Delicate Balance

Despite persistent property market challenges, China’s quest to hit its growth target is a high-stakes endeavor. The government’s strategic fiscal interventions and ability to foster regional investment initiatives are pivotal. As China navigates this complex terrain, its policymakers’ capacity for strategic decision-making, resilience, and adaptability will be critical in steering the economy toward sustainable growth.

China’s Growth Dynamics: Global Economic Ripple Effects

China’s ambitious growth targets are more than just national objectives; they are significant levers that sway the global economic landscape. As the world’s second-largest economy, fluctuations in China’s growth trajectory send waves through international markets, affecting everything from global sentiment to commodity prices. This comprehensive analysis explores the multifaceted impact of China’s economic performance on the world stage, supported by pertinent facts and figures to underscore its global significance.

1. Influence on Global Economic Sentiment

– Market Confidence: China’s economic indicators are critical in shaping global investor confidence. A miss on growth targets can trigger worldwide market volatility. In 2019, the IMF estimated that a 1% decline in China’s GDP could reduce global growth by up to 0.2%.

– Investment Decisions: The global financial community scrutinizes China’s economic health, and any perceived weakness could lead to more conservative investment strategies internationally.

2. Effects on Trade Partners and Global Supply Chains

– Trade Dynamics: China’s role as a significant importer means its economic health directly influences its trading partners. For instance, China accounted for about 11% of global imports in 2020, making it a critical market for many countries.

– Supply Chain Connectivity: Given China’s central position in global supply chains, disruptions within its economy can have worldwide implications, affecting everything from electronics to automotive industries.

3. Impacts on Commodity Markets

– Commodity Consumption: As a leading consumer of commodities, China’s economic activity significantly influences global prices. In 2021, China consumed over half of the world’s iron ore production, underlining its impact on the metals market.

– Price Fluctuations: A downturn in China’s economy can decrease commodity demand, adversely affecting the economies of commodity-exporting nations.

4. Repercussions for Financial Markets

– Market Volatility: China’s financial market movements have global implications. For instance, fluctuations in China’s stock and bond markets can affect global liquidity and investor sentiment.

– Policy Observations: China’s monetary and fiscal policies are closely watched by international investors, as they can signal broader economic trends and risks.

5. Dynamics of Investment Flows

– FDI Considerations: Challenges in China’s economic landscape might deter foreign direct investment (FDI), which totaled USD 163 billion in 2020, reflecting its role as a significant global investment destination.

– Outbound Investments: China’s investments abroad, particularly in infrastructure and technology, are vital economic stimuli for recipient countries.

6. Currency Exchange Rate Implications

– Trade Balances and Exchange Rates: The value of the Chinese yuan affects global trade dynamics and exchange rates. A weaker yuan can make Chinese goods more competitive internationally and affect trade balances with other countries.

7. Geopolitical and Economic Power

– Global Influence: China’s economic status is a cornerstone of its geopolitical power. Economic challenges could alter its international relationships and strategic partnerships.

– Diplomatic Relations: Economic performance impacts China’s capacity to engage in and influence global governance and international economic policy.

8. Consumer Market Effects

– Global Brands and Spending Patterns: The purchasing power of China’s burgeoning middle class, with disposable income growth outpacing that of other nations, is crucial for global consumer markets. A slowdown significantly affects multinational corporations.

9. Global Financial Stability and Debt Risks

– Debt Monitoring: The international financial system is sensitive to China’s debt levels, given their potential to trigger wider financial instabilities. China’s total debt reached approximately 300% of its GDP by the end of 2020.

10. Innovation and Technological Advancement

– Global Tech Landscape: China’s contributions to global R&D and its role in shaping technological trends are profound. Its commitment to innovation drives worldwide competitive and collaborative dynamics in the tech sector.

Conclusion

China’s economic trajectory is a global concern, intertwining with the fortunes of countries, markets, and industries worldwide. As policymakers, investors, and businesses worldwide monitor China’s economic indicators, its ability to navigate its growth challenges remains pivotal in the global economic dialogue.

No Comments