The Global Debt Crisis: Unveiling Systemic Risk and Its Threat to Sustainable Development

Farhad Reyazat – London School of Banking and Finance ( Biography )

Citation: Reyazat, F. (2024, September 10). The global debt Crisis: unveiling systemic risk and its threat to sustainable development. London School of Banking and Finance. https://www.reyazat.com/2024/09/10/the-global-debt-crisis-unveiling-systemic-risk-and-its-threat-to-sustainable-development/

The state of global debt has become a critical area of focus as the world navigates economic uncertainties, inflation pressures, and geopolitical challenges.

The above two visual data representations highlight sectoral and country-specific debt dynamics for Q1 2024. With the global total debt reaching a staggering $315.1 trillion, understanding the intricate distribution of this debt by sector and country is crucial for interpreting the global financial landscape.

1. Global Debt by Sector – Q1 2024

The first infographic, sourced from the Institute of International Finance, breaks down global debt by sector across both mature and emerging markets.

Mature Markets hold the lion’s share of the debt, $209.7 trillion. This is distributed among households, non-financial corporations, financial sectors, and government debt.

The government sector in mature markets holds the most significant portion, at $63.0 trillion, or 30% of the debt. This sector also saw the highest annual increase, rising by 5.8% yearly.

– Households in these markets contribute $39.9 trillion (19%), while non-financial corporates and financial sectors hold $50.2 trillion (24%) and $56.5 trillion (27%), respectively.

– Emerging Markets, while having significantly lower debt in absolute terms, still hold $105.4 trillion.

– Here, the government sector again stands out, with $44.0 trillion, making up 42% of emerging markets’ debt.

– Households hold $19.2 trillion (18%), while non-financial corporates and the financial sector contribute $28.4 trillion (27%) and $13.9 trillion (13%) respectively.

Key Observations from the Sectoral Debt Data:

Government debt significantly drives the overall global debt increase, particularly in mature markets. This correlates with increased fiscal spending, stimulus packages, and deficits due to inflation management, economic slowdowns, and geopolitical instability.

– Non-financial corporates have significant leverage, especially in mature markets, which raises concerns about how these sectors will manage rising interest rates and tightening monetary policies.

– The household debt burden in mature markets, accounting for nearly 20% of their total debt, could pose risks, particularly if inflation erodes real incomes and household borrowing becomes more challenging.

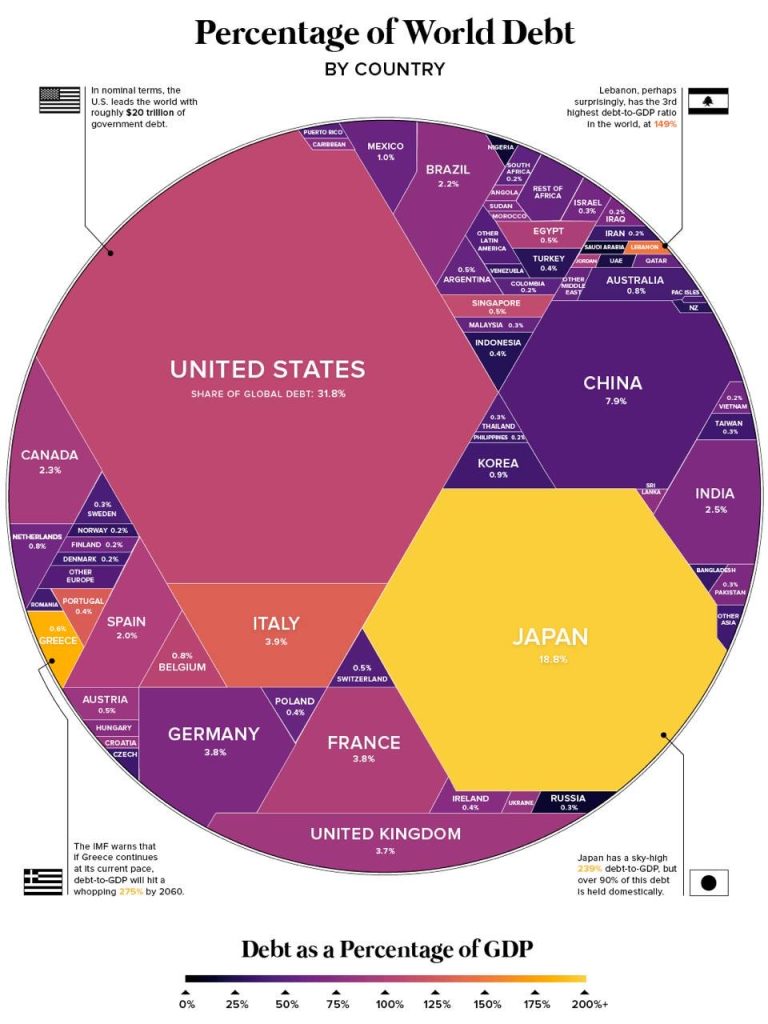

2. Global Debt Distribution by Country – Q1 2024

The second graphic illustrates the percentage of world debt by country and the debt-to-GDP ratios, giving a clearer picture of which nations contribute most to the global debt pile.

– The United States leads the world with 31.8% of global debt (roughly $20 trillion in government debt). Given its economic size and international influence, U.S. debt policies and interest rates continue to impact global markets. However, the U.S. has faced growing pressure from rising interest costs and political debates over debt ceilings.

Japan follows, holding 18.8% of global debt despite its smaller GDP than the U.S. Japan has a very high debt-to-GDP ratio, which exceeds 200%, driven by decades of low interest rates and economic stimulus efforts. However, much of Japan’s debt is held domestically, which reduces its exposure to international shocks.

– China accounts for 7.9% of global debt. China’s debt accumulation has increased due to its state-led growth model, significant infrastructure investments, and rising debt within its corporate sector. However, China’s local governments’ “hidden debt” and the property market’s struggles are potential concerns for global markets.

– Italy (3.9% of global debt) and France (3.8% of global debt) are among the most significant contributors in Europe. Italy’s high debt-to-GDP ratio, expected to rise even further, has long been a concern within the Eurozone.

Debt-to-GDP Ratios and Risks:

– Many advanced economies have high debt-to-GDP ratios. Japan’s ratio exceeds 200%, and other countries like Lebanon (with a ratio of 149%) are grappling with unsustainable debt levels that threaten economic stability.

– Lebanon’s high debt-to-GDP ratio points to severe fiscal instability, and the country’s ongoing financial crisis exacerbates the difficulty in managing this debt.

Interrelation Between Sectoral and Country-Level Debt Data

The sectoral and country-level data complement each other, providing a fuller understanding of the global debt landscape.

– Government Debt as a Global Driver: Both graphics highlight that government debt is one of the main drivers of global debt, whether in mature markets, emerging markets, or specific countries. For example, the U.S., Japan, and China have all experienced massive government borrowing to fund fiscal policies and stimulate their economies.

Household and Corporate Debt: Mature markets, such as the U.S. and Europe, tend to have high levels of household debt, whereas emerging markets like China and India have seen increasing levels of corporate and government debt. Rising household debt in mature markets and stagnating wages may strain economic growth, while corporate debt poses a risk, particularly in the context of higher interest rates globally.

– Impact of Rising Interest Rates: As central banks around the world tighten monetary policy in response to inflation, countries and sectors with high debt exposure may face difficulties servicing their debt. Mature markets, with high household and corporate debt, are particularly vulnerable to rising rates while emerging markets could struggle with currency volatility and capital outflows as global borrowing costs rise.

– Emerging Markets’ Growing Share: Although emerging markets hold a smaller share of global debt, they are experiencing rapid growth in government borrowing. These countries are often more vulnerable to global economic shifts, such as changes in commodity prices or currency exchange rates.

The Burden of Debt: Why Developing Countries Struggle with High Interest Rates and Limited Growth

Developing countries face numerous economic challenges, one of the most prominent being the crushing debt burden, mainly due to high interest payments.

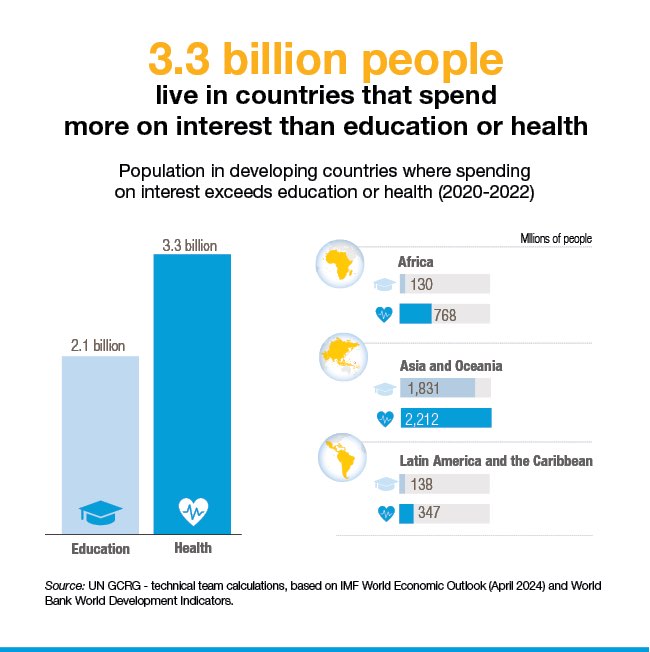

The series of charts above offers critical insight into the disproportionate amount of money developing countries spend on interest, which often exceeds expenditures on essential sectors like health and education.

1. Spending More on Interest than Education or Health

One of the starkest figures is that 3.3 billion people live in countries where spending on interest payments surpasses that of health or education. This is especially concerning in regions such as Africa, Asia, Oceania, and Latin America, where a significant portion of government budgets is directed towards servicing debt rather than investing in vital public services. For instance:

– In Africa, while 768 million people live in countries where health expenditures lag behind interest payments, only 130 million reside in countries that prioritize education.

– Asia and Oceania, with the largest share of this global population, are home to over 2.2 billion people whose governments are forced to prioritize debt repayment over health, affecting long-term human capital development.

This trend has severe implications for sustainable development. When a country allocates more resources to servicing debt rather than education or healthcare, it hinders the population’s ability to break free from the poverty trap, perpetuating a cycle of underdevelopment.

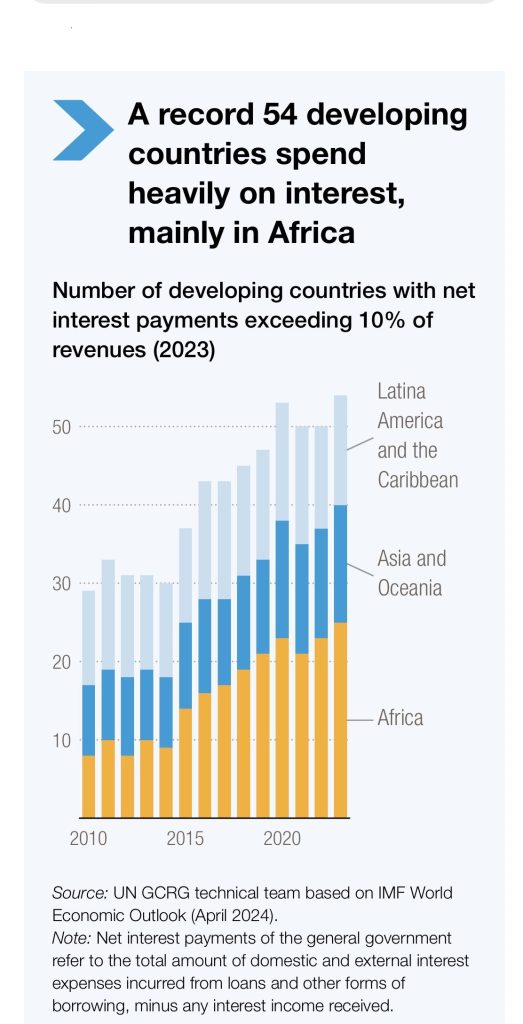

2. High Borrowing Costs and Debt Servicing

The second visual shows that 54 developing countries spend more than 10% of their revenues on interest payments, with Africa leading the pack. This high level of debt servicing limits these countries’ ability to invest in their economies and improve living standards. A significant portion of revenue is being used not for growth or infrastructure projects but for paying off past loans, which often carry steep interest rates.

According to the IMF, the net interest payments are driven by domestic and external borrowing, with many developing nations turning to external creditors to finance their growth. These high borrowing levels come with risks, especially when combined with currency depreciation and increasing inflation, further compounding the cost of debt repayment.

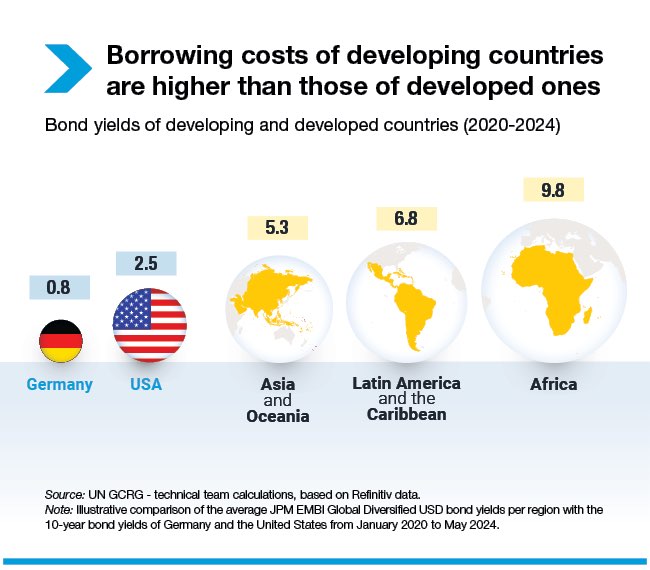

3. Disparity in Borrowing Costs

The third visual highlights a critical issue: developing countries face significantly higher borrowing costs than developed countries. For instance:

– In Africa, the average bond yield stands at a staggering 9.8%, while in Latin America and the Caribbean, it is 6.8%. In contrast, developed economies like Germany and the USA enjoy much lower rates at 0.8% and 2.5%, respectively.

These higher borrowing costs place developing nations at a severe disadvantage. Capital investment in these regions is crucial for development, but high interest rates mean that the cost of borrowing is unsustainable, leading to increased debt burdens and reduced fiscal space for other vital investments like infrastructure, education, or social programs.

Why Are Developing Countries Stuck with High-Interest Payments?

Several factors contribute to the high levels of interest payments in developing countries, including:

– Perceived Risk: Investors see developing countries as riskier investments due to political instability, weaker institutions, and lower credit ratings, which drive up the cost of borrowing.

– Currency Risk: Many developing countries borrow in foreign currencies, particularly US dollars. When their local currency depreciates, the cost of repaying these debts increases.

Lack of Access to Cheaper Capital: Unlike developed countries, which have access to cheaper borrowing through their established financial markets, developing countries often rely on international lenders or bond markets with higher yields.

– Debt Accumulation: Years of borrowing to fund economic growth without corresponding improvements in revenue generation or economic stability have left many countries with unsustainable debt levels.

The Impact of Debt on Development

These countries’ high debt servicing levels have profound implications for their growth potential. Spending more on interest than education or health undermines long-term development goals, such as improving literacy rates, reducing child mortality, and combating poverty. Failing to invest in human capital limits these countries’ ability to compete in the global economy.

Furthermore, high borrowing costs and the inability to generate enough revenue to service debts lead to reliance on further borrowing, perpetuating a vicious cycle. As debt burdens grow, so does the likelihood of default or the need for austerity measures, which can further cripple economic growth and social development.

Global Solutions and Recommendations

To alleviate the debt burden on developing countries, several global actions are necessary:

1. Debt Relief Initiatives: International organizations like the IMF and World Bank should continue to explore debt relief initiatives for the most heavily indebted countries, allowing them to redirect funds toward development goals.

2. Reforming Borrowing Practices: Developing countries need to improve governance and financial transparency to reduce the perceived risks of lending and secure better borrowing terms.

3. Access to Low-Cost Capital: Programs that provide developing nations access to cheaper capital for sustainable projects can help reduce their reliance on high-interest loans. Green bonds or development-focused financial instruments can also offer alternatives to traditional borrowing.

Conclusion

The global debt crisis, particularly in developing countries, is not just an economic issue but a human development challenge. The fact that 3.3 billion people live in nations where interest payments outweigh critical sectors like education and health is a sobering reminder of the need for global financial reform. Without action, many developing countries may remain trapped in a cycle of debt and underdevelopment, unable to invest in the future of their people. Lowering borrowing costs, improving access to affordable capital, and prioritizing debt relief are essential steps toward a more equitable global economic system.

This challenge is intimately tied to the United Nations Sustainable Development Goals (SDGs), particularly Goal 1 (No Poverty), Goal 3 (Good Health and Well-Being), and Goal 4 (Quality Education). For developing nations to meet these goals by the 2030 deadline, addressing the debt crisis must be a priority. Countries that spend more on debt servicing than healthcare and education are less likely to achieve the SDGs, as they lack the financial resources to invest in critical infrastructure, social services, and human capital development.

The global debt burden also threatens Goal 10 (Reduced Inequality) and Goal 17 (Partnerships for the Goals). It exacerbates disparities between developed and developing countries, making it harder for low-income nations to catch up with their wealthier counterparts. By promoting debt relief, lowering borrowing costs, and improving access to affordable capital, the global community can help foster the financial conditions needed for sustainable development.

Looking Ahead: What Does This Mean for the Global Economy?

The global debt crisis remains a significant challenge, particularly as countries balance fostering growth and managing their borrowing costs. As government debt rises globally, inflationary pressures, rising interest rates, and geopolitical uncertainty create an increasingly fragile environment.

– For mature markets, government debt levels will be a crucial area to watch, especially in the context of fiscal policies aimed at supporting economic recovery from the pandemic and controlling inflation.

– Emerging markets must carefully manage their rising debt burdens, as they are more exposed to external shocks, especially with tightening global financial conditions.

In conclusion, while the global debt of $315.1 trillion is a staggering figure, it is not just the size of the debt that matters but where it is concentrated (government, corporate, and household sectors) and which countries hold the most debt. Understanding these dynamics is crucial for policy-makers, investors, and global financial institutions navigating a complex and evolving economic environment.

Achieving the Agenda 2030 goals will require more than economic growth; it will demand a rethinking of global financial structures, prioritizing debt sustainability, and ensuring that the most vulnerable nations have the fiscal space to invest in their people’s well-being. The global community can make meaningful progress toward a more equitable and sustainable future by aligning debt management policies with the SDGs.

References

What is ‘global debt’ – and how high is it now? (2023, December 21). World Economic Forum. https://www.weforum.org/agenda/2023/12/what-is-global-debt-why-high/

Global Debt Report 2024. https://www.oecd-ilibrary.org/finance-and-investment/global-debt-report-2024_91844ea2-en

Global Risks Report 2024 | World Economic Forum. (n.d.). World Economic Forum. https://www.weforum.org/publications/global-risks-report-2024/in-full/?utm_source=google&utm_medium=ppc&utm_campaign=globalrisks&gad_source=1&gclid=CjwKCAjwufq2BhAmEiwAnZqw8toGYDof3wioxBPuFMtx4oHmK_I2_RONus29Pwrd42GmSm-MuGrCiBoCd8gQAvD_BwE

Debt Justice. (2022, May 12). Countries in crisis – Debt Justice. Debt Justice – International Debt Charity. https://debtjustice.org.uk/countries-in-crisis

The Global Debt Crisis: Challenges of reality and Alternatives for the future. (n.d.). https://trendsresearch.org/insight/the-global-debt-crisis-challenges-of-reality-and-alternatives-for-the-future/

Kenworthy, P., Kose, M. A., & Perevalov, N. (2024, April 24). A silent debt crisis is engulfing developing economies with weak credit ratings. World Bank Blogs. https://blogs.worldbank.org/en/voices/silent-debt-crisis-engulfing-developing-economies-weak-credit-ratings

The Economist. (2024, April 18). Can the IMF solve the poor world’s debt crisis? The Economist. https://www.economist.com/finance-and-economics/2024/04/18/can-the-imf-solve-the-poor-worlds-debt-crisis

Thurston, A. (2023, August 30). What is the sovereign debt crisis and can we solve it? Boston University. https://www.bu.edu/articles/2023/what-is-the-sovereign-debt-crisis-and-can-we-solve-it/

No Comments