Global Debt Dynamics: Economic Stability and Risks Across Major Economies

Farhad Reyazat- PhD in Risk Management

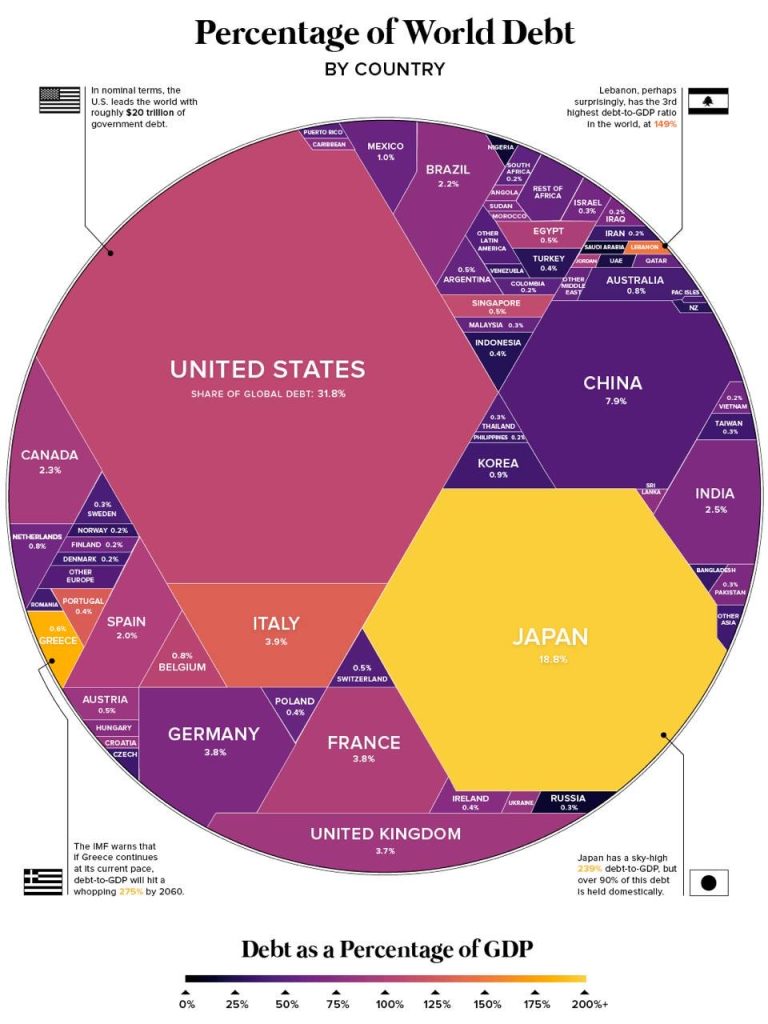

The global debt landscape is a critical indicator of economic stability and potential vulnerabilities across nations. This analysis delves into the distribution of global debt, highlighting the significant figures and facts that shape the current economic environment.

United States: The World’s Largest Debtor

The United States holds a staggering 31.8% of the world’s total debt, translating to approximately $20 trillion in government liabilities. This massive debt load reflects the country’s economic size, with a GDP of over $25 trillion. Despite this, the U.S. continues to benefit from the dollar’s status as the world’s primary reserve currency, allowing it to manage such a high debt burden without facing immediate financial distress. However, with the debt-to-GDP ratio approaching 125%, concerns about long-term fiscal sustainability remain a topic of intense discussion among economists.

Japan: High Debt, Low Risk?

Japan accounts for 18.8% of global debt, with its national debt exceeding $12 trillion. Japan’s debt-to-GDP ratio is among the highest in the world at over 230%. Interestingly, over 90% of this debt is held domestically, providing a buffer against external financial pressures. Nonetheless, Japan’s aging population and slow economic growth present challenges in managing this enormous debt, raising questions about the sustainability of its economic model in the coming decades.

China: A Rising Economic Power with Growing Debt

China, the world’s second-largest economy, holds 7.9% of global debt. With a GDP of over $18 trillion, China’s debt-to-GDP ratio is relatively moderate compared to other major economies. However, China’s total debt—including corporate, local government, and national government liabilities—is estimated to be around $14 trillion. The rapid accumulation of debt, particularly in the corporate sector, has raised concerns about financial stability, especially in the face of potential slowdowns in economic growth.

Eurozone Economies: Diverse Challenges

The Eurozone presents a diverse debt landscape, with countries like Germany, France, Italy, and the UK each holding around 3.7% to 3.9% of global debt. Italy, in particular, stands out with a debt-to-GDP ratio of over 150%, making it one of the most indebted economies in the region. Greece, with a debt-to-GDP ratio expected to reach 275% by 2060, faces significant risks, as warned by the IMF. The ongoing debt challenges in the Eurozone highlight the need for careful fiscal management and potential reforms to ensure long-term economic stability.

Emerging Markets: Navigating Debt in a Volatile Environment

Emerging markets such as Brazil, India, and Mexico collectively account for a moderate share of global debt, with each holding between 1% and 2.5%. These countries face higher interest rates and currency risks, making their debt burdens more challenging to manage. For example, Brazil, with a debt-to-GDP ratio of 98%, and India, at 85%, must navigate the complexities of sustaining economic growth while managing their debt levels.

Lebanon presents a particularly dire case, with a debt-to-GDP ratio of 149%, placing it among the highest in the world. The country’s ongoing economic crisis has led to a significant reduction in its ability to service debt, raising the specter of default or the need for international financial assistance.

The Global Economic Implications

The distribution of global debt among these major economies underscores several critical issues:

– Debt Sustainability: Countries with high debt-to-GDP ratios, particularly Japan, Greece, and Italy, face significant risks of economic stagnation or default if they cannot manage or reduce their debt levels.

– Economic Power and Debt Concentration: The U.S., Japan, and China together hold nearly 60% of global debt. This concentration means that global economic stability is heavily dependent on the financial health of these few nations.

– Interest Rates and Monetary Policy: High levels of debt in major economies, especially the U.S., mean that changes in global interest rates could have widespread implications. A rise in interest rates could increase debt servicing costs, potentially leading to slower economic growth and higher default risks.

– Emerging Market Vulnerabilities: Emerging economies with growing debt burdens are particularly vulnerable to external shocks, such as fluctuations in commodity prices or global financial conditions. These countries may need to implement stringent fiscal policies or seek international financial assistance to manage their debts.

Conclusion

The global debt landscape presents a complex and nuanced picture of economic stability and risk. The ability of major economies to manage their debt levels will be crucial in maintaining global economic stability. As some nations approach or exceed critical debt-to-GDP thresholds, the potential for economic disruptions increases, underscoring the need for global cooperation and sound fiscal management.

No Comments