Gold Rush 2024: Central Banks Hoard, Prices Soar!

Dr. Farhad Reyazat

23 March 2024

Citation: Reyazat, F. (2024, March 23). Gold Rush 2024: Central banks hoard, prices soar! Farhad Reyazat. https://www.reyazat.com/2024/03/23/central-banks-are-hoarding-gold/

In central banking, the new year began much like the previous one ended—with a strong appetite for gold. Central banks globally continued adding to their gold reserves in January 2024. According to data compiled by the World Gold Council, these institutions collectively increased their gold holdings by a net 39 tons during that month.

Here are some notable highlights:

- Turkey: Despite being a net seller in 2023, Turkey shifted gears and became the biggest buyer in January 2024. The Central Bank of Turkey added 12 tons of gold to its reserves, totaling552 tons. The previous gold sales responded to local market dynamics and did not necessarily reflect a long-term strategy change.

- China: The People’s Bank of China continued its steady accumulation of gold, purchasing 10 tons in January. China’s official gold holdings now stand at 2,245 tons, although speculation is that the country may hold even more gold “off the books.”

- India: The Reserve Bank of India resumed its gold-buying spree after a brief hiatus. It added 9 tons to its reserves, bringing its total purchases since late 2017 to over 200 tons.

- Kazakhstan: After being a consistent seller in 2023, the Kazakh central bank returned to buying gold in January, acquiring 6 tons.

- Jordan and the Czech Republic: These smaller nations also increased their gold holdings. The Central Bank of Jordan added 3 tons, while the Czech National Bank made its 11th consecutive monthly purchase with 2 tons.

- Russia: The Central Bank of Russia reported a 3-ton decline in its gold reserves. This pattern has been consistent since 2021, with frequent declines followed by replenishments.

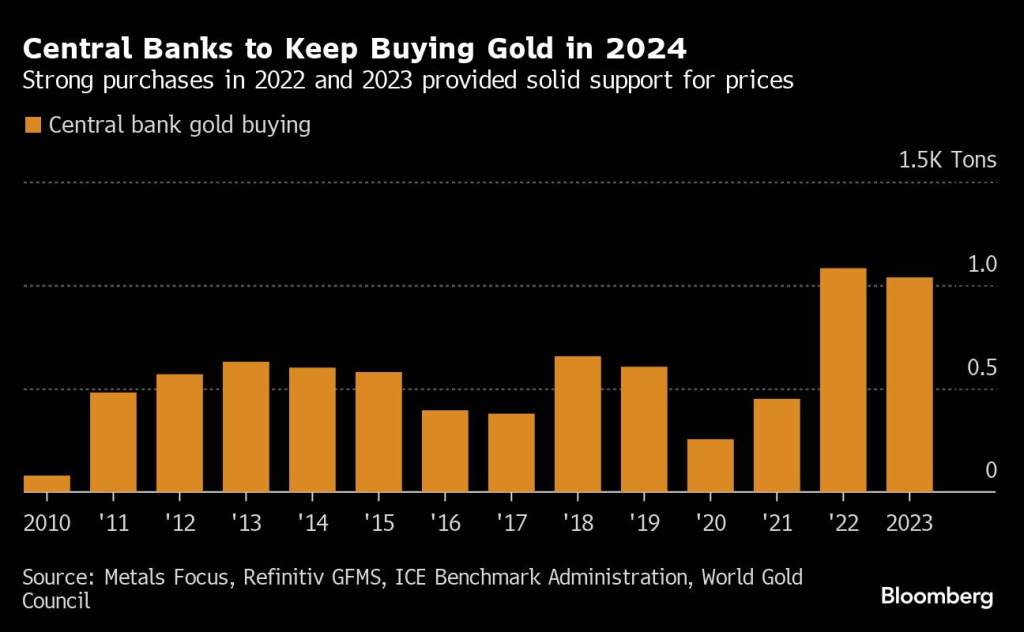

Central banks’ net gold purchases totaled 1,037 tons in 2023, marking the second consecutive year they added more than 1,000 tons to their reserves. This trend builds upon the record year of 2022 when total central bank gold buying reached 1,136 tons. The allure of gold remains vital for central banks, serving as a reliable store of value and a hedge against economic uncertainties.

Central Banks’ Gold Purchases Over Time

The chart illustrates the amount of gold bought by central banks each year from 2010 to 2023. Here are the key takeaways:

- Net Purchases: The trend shows that central banks have consistently accumulated gold over the years, which continued into 2024.

- Strong Support for Gold: The substantial purchases in 2022 and 2023 supported gold prices. Central bank demand remains a crucial factor in the gold market.

- Monthly Accumulation: In January 2024, central banks added 39 tonnes to global gold reserves, marking the eighth consecutive month of net purchases.

- Leading Buyers:

- Central Bank of Turkey: It was the largest buyer, increasing its official gold holdings by 12 tonnes.

- People’s Bank of China: China continued its streak, adding 10 tonnes for the 15th consecutive month.

- Reserve Bank of India: After a pause, it saw its first monthly increase in gold reserves since October 2023, adding nearly 9 tonnes.

- Other banks like the National Bank of Kazakhstan, Central Bank of Jordan, and Czech National Bank also contributed to the upward trend in gold reserves.

- Robust Interest in Gold: Central banks’ interest in gold remains robust, signaling a continued preference for this precious metal in their reserve portfolios.

Remember, this chart reflects the ongoing dynamics of central banks’ gold accumulation, significantly shaping the global gold market.

Central Banks’ Gold Buying in 2024-2025

The crystal ball of central banking decisions remains cloudy, but let us peer into its depths with speculative curiosity. 2024 and 2025, those twin years on the horizon, beckon central banks to dance with gold once more. Will they twirl in its golden embrace or step back from the ballroom? Let us consider the waltz of possibilities:

- The Bullion Ballet Continues:

- Central banks, those guardians of monetary stability, have shown a penchant for accumulating gold. Their vaults echo with the clinking of bars, and their ledgers record net purchases.

- The themes that fueled their desire—geopolitical uncertainties, inflation murmurs, and diversification—may persist. If so, the gold-buying pas de deux shall endure.

- Turkey’s Golden Affair:

- The Central Bank of Turkey, like a magpie drawn to shiny treasures, has been a voracious buyer. Will it continue to add to its glittering hoard? The answer lies in Ankara’s chambers.

- China’s Steady Tango:

- The People’s Bank of China, with its 15-month streak, has pirouetted through the gold market. Will it extend its dance? The Great Wall holds its secrets.

- India’s Rekindled Flame:

- The Reserve Bank of India, after a brief pause, rekindled its love for gold. Will this newfound passion endure? Mumbai’s monsoons may whisper the answer.

- Kazakhstan’s Cossack Spin:

- The National Bank of Kazakhstan, Central Bank of Jordan, and Czech National Bank—all joined the golden reel. Will they maintain their steps, or will other assets lure them away?

- Black Swan Waltz:

- Ah, the black swans! Those unexpected guests crash the party. Pandemics, financial crises, or cosmic events—they can sway central banks’ decisions. Their feathers remain unpredictable.

- Digital Shadows Loom:

- Cryptocurrencies, those digital upstarts, cast long shadows. Will central banks glance at their screens, pondering Bitcoin’s ascent? Or will they remain steadfast in their golden tradition?

- Supply-Side Minuet:

- Mines dig, refining their choreography. Will discoveries pirouette forth, or will the mines tire? The supply-side ballet influences the dance.

- Sentimental Waltz:

- Fear and greed, those twin partners, sway the markets. Sentimental strings play, and central banks listen. Will they sway with the music or stand stoic?

- The Final Curtain Call:

- As the curtains draw near, central banks weigh their options. Gold, that ancient luminary, awaits its cue. Will it take center stage or fade into the wings?

In this grand theater of finance, the script remains unwritten. Central banks, those masked dancers, hold their secrets close. However, Central banks’ decisions to continue purchasing gold in 2024-2025 would depend on various factors, including economic conditions, inflation rates, currency stability, and geopolitical tensions. Historically, central banks have viewed gold as a safe-haven asset and a way to diversify their reserves, especially in times of economic uncertainty or when there is a lack of confidence in other reserve assets.

Several factors could influence continued gold purchases:

1. Inflation and Currency Depreciation: High inflation rates or depreciation of fiat currencies can lead to increased gold buying as central banks seek to preserve value.

2. Geopolitical Stability: Geopolitical tensions often prompt central banks to increase their gold reserves to hedge against potential financial instability.

3. Diversification: To mitigate risks associated with holding a single currency or asset class, diversifying reserves can drive gold acquisitions.

4. Market Conditions: The price of gold, expectations of future price movements, and the overall outlook for the global economy can influence central bank buying behavior.

5. Regulatory Changes: Changes in international regulations or recommendations regarding reserve assets might also impact how central banks view gold holdings.

Given these considerations, if the factors that have traditionally driven central bank purchases of gold remain relevant or intensify, it’s plausible that central banks might continue or even increase their gold acquisitions in 2024 and 2025.

Gold price over the last five years

Gold price per Ounce Source: Author

- Current Price: Gold per troy ounce is approximately $2,165.17.

- 5-Year Change: Over the last five years, gold has experienced a significant increase. The current price reflects a 65.53% rise compared to 5 years ago, translating to an additional value of $859.21 per ounce.

- Highs and Lows:

- 5-Year High: Gold peaked at $2,210.66 per ounce during this period.

- 5-Year Low: The lowest point was around $1,269.50 per ounce.

Various factors, including global economic conditions, geopolitical events, and investor sentiment, have influenced gold prices. It remains a sought-after asset for its historical store of value and as a hedge against uncertainties.

The future Gold Price

The future of gold prices is akin to gazing into the shifting sands of time, where economic tides ebb and flow and investor sentiments sway like autumn leaves in the wind.

Allow me to don my speculative hat and peer into the crystal ball of financial musings:

- Macro Forces at Play:

- Inflation Whispers: As whispers of inflation echo through the corridors of monetary policy, gold may find itself donning its glimmering armor. Historically, gold has been a hedge against inflation, shielding investors from the erosive effects of rising prices.

- Interest Rates Ballet: The delicate dance of central banks—raising or lowering interest rates—can sway gold’s fortunes. When rates waltz upward, gold often sulks; when they pirouette downward, gold twirls with delight.

- Geopolitical Drama: Similar to Shakespearean tragedies, geopolitical tensions can scare investors toward the golden haven. Trade wars, political upheavals, and saber-rattling play their part in this dramatic saga.

- Digital Challengers:

- Cryptocurrencies: The crypto knights, led by Bitcoin and Ethereum, have stormed the castle gates. Their digital banners flutter, challenging gold’s supremacy. Will gold hold its ground, or will it yield to the blockchain revolution?

- Blockchain Bling: Some argue that blockchain technology itself—immutable, decentralized, and shiny—could be the true gem, rendering physical gold a relic of yesteryears.

- Sentimental Serenades:

- Fear and Greed: The pendulum of investor emotions swings wide. Fear sends them clutching their gold bars; greed tempts them to trade it for moon-bound tokens. Sentiment, fickle as a spring breeze, can sway gold’s trajectory.

- Psychological Anchors: Gold’s allure lies in its intrinsic value and the stories around it. The Midas touch, alchemical quests, and pirate treasure maps whisper secrets to the human psyche.

- Supply and Demand Ballet:

- Mining Minutes: The miners toil, extracting gold from Earth’s veins. Their choreography affects supply. Will discoveries pirouette forth, or will the mines tire and slow their dance?

- Jewelry Jigs: Gold’s dalliance with jewelry is timeless. Will adornments continue to twirl in gold’s embrace, or will other metals steal the dance floor?

- Technological Alchemy:

- Synthetic Sorcery: Lab-grown gold, synthesized without Earth’s touch, may join the masquerade. Will investors discern the difference, or will they dance with the impostor?

- Space Odyssey: Asteroid mining—an interstellar ballet. Earth’s supply may waltz into the cosmos if celestial bodies yield their golden secrets.

- Black Swan Pas de Deux:

- Unpredictable Feathers: Black swans glide silently, their feathers ruffling markets. Pandemics, meteor strikes, alien invasions—these unexpected guests can pirouette gold prices into uncharted realms.

In the grand theater of finance, gold remains an enigmatic lead actor. Written in the annals of time, its script awaits the next act.

Disclaimer: This whimsical analysis is to write this article only. Actual prices and central bank decisions may vary.

Sources:

- Central banks accumulate more gold in January – starting in 2024, as they mean to go on. (March 2024). World Gold Council. https://www.gold.org/goldhub/gold-focus/2024/03/central-banks-accumulate-more-gold-january-starting-2024-they-mean-go

- 2024 started as 2023 ended with central banks buying more gold. (2024, March 7). Gold Eagle. https://www.gold-eagle.com/article/2024-started-2023-ended-central-banks-buying-more-gold

- Ray Jia (2024, March 13)China’s gold market in February: demand steady, gold reserves higher. World Gold Council. https://www.gold.org/goldhub/gold-focus/2024/03/chinas-gold-market-february-demand-steady-gold-reserves-higher

- Juan Carlos Artigas ( 2024, March 12) You asked, and we answered: What’s behind Gold’s March rally? World Gold Council. https://www.gold.org/goldhub/gold-focus/2024/03/you-asked-we-answered-whats-behind-golds-march-rally

- Maharrey, M. (2024, March 7). 2024 started as 2023 ended with central banks buying more gold. Money Metals Exchange. https://www.moneymetals.com/news/2024/03/07/2024-started-as-2023-ended-with-central-banks-buying-more-gold-003035

No Comments