The Battle of the Banks: A Week of Crucial Rate Decisions Ahead

Dr Farhad Reyazat – London School of Banking and Finance

18th of March 2024

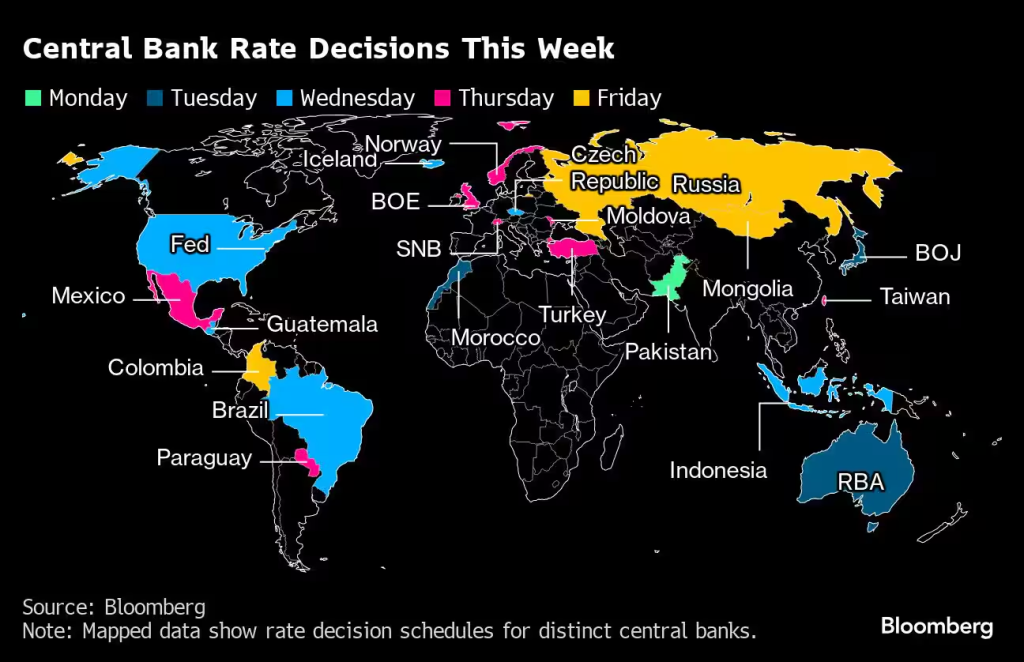

The upcoming week marks a pivotal moment in 2024, hosting a significant cluster of rate decisions that could impact the cost of borrowing across six of the ten most actively traded currencies. This period will offer insights into the Federal Reserve’s determination to relax its monetary stance and Japan’s proximity to leaving behind its era of negative interest rates. With policies affecting nearly half of the global economy being decided, this week is critical for understanding the diverse approaches central banks are taking toward inflation risks.

Let’s explore the financial world and explore the central bank decisions and economic developments for this week:

- Eurozone Inflation Metrics:

- Our focus in the Eurozone centers around the final inflation numbers for February. These figures provide insights into the inflation metrics the European Central Bank (ECB) monitors. Understanding the factors contributing to February’s notably high core inflation is crucial for policymakers and investors alike.

- Bank of Japan (BoJ):

- The BoJ is wrapping up its two-day policy meeting. Analysts’ predictions are mixed, but there’s a significant piece of information—the recent preliminary wage data from the “spring wage offensive.” This data could potentially influence the BoJ’s decision to increase the policy rate from negative figures. However, the impact on small and medium enterprises (SMEs) remains uncertain. Given the persistent inflation in the US and the Fed’s delayed rate cuts, the BoJ is expected to proceed cautiously.

- Reserve Bank of Australia (RBA):

- The RBA is gearing up for a monetary policy meeting early tomorrow. Market expectations align with no policy changes, but surprises are always possible.

- Upcoming Central Bank Decisions:

- Wednesday: The Federal Open Market Committee (FOMC) is not expected to make any changes.

- Thursday: A busy day! Decisions are due from Norges Bank (NB), the Bank of England (BoE), and the Swiss National Bank (SNB). The SNB is anticipated to announce a 25 basis point reduction. PMI data from the UK, US, and Eurozone will also be released.

- These central bank moves will significantly impact global markets.

- Recent Developments in China:

- China’s latest data reveals stronger-than-expected industrial production growth, reaching 7.0% year-over-year for January/February. Retail sales and housing data also show positive trends, hinting at a potential recovery in the housing sector. Financial markets responded optimistically, hopeful that China’s economic downturn may be reversing.

- United States:

- The University of Michigan’s preliminary consumer sentiment index for March remained stable, with a slight expectation dip. This stability in inflation expectations is a positive signal for the Federal Reserve (Fed). Additionally, February witnessed a slight increase in industrial production.

- Japan:

- The Rengo labor union reported a significant wage increase for workers at major firms. This development is crucial for Japan’s economic policy. We eagerly await further details from subsequent reports.

- Russia:

- In recent presidential elections, President Putin secured another six-year term. His victory has implications for Russia’s political and economic landscape.

- Stock and Bond Markets:

- Last week, global equities dipped, with bond markets closely monitoring rising yields driven by high inflation. Surprisingly, the negative impact on equities was less severe than expected. The energy and materials sectors exhibited strength amid inflation concerns. Notably, Asian markets, especially Japan, showed positive movement in anticipation of the Bank of Japan (BoJ) meeting.

- Bond Market:

- European bonds experienced a stable trading session on Friday. German yields and Bund asset swap spreads showed minor changes. Market expectations suggest that the Bund ASW (asset swap spread) may soon surpass the 30 basis point (bp) mark due to ongoing market drivers.

- Foreign Exchange:

- Key central bank decisions will heavily influence the upcoming week in foreign exchange markets.

- The outcome remains uncertain While no change is expected from the BoJ.

- The Swiss Franc might weaken if the Swiss National Bank (SNB) proceeds with a rate cut.

- The movement of the US dollar will depend on the Fed’s stance regarding recent interest rate adjustments.

- Key central bank decisions will heavily influence the upcoming week in foreign exchange markets.

Sources:

- EMEA Morning briefing: Central bank’s policy decisions are in focus this week. (2024, March 18). Morningstar, Inc. https://www.morningstar.com/news/dow-jones/20240318269/emea-morning-briefing-central-banks-policy-decisions-in-focus-this-week

- DailyFX. (2024, March 18). Central Bank release calendar & current interest rates. DailyFX. https://www.dailyfx.com/central-bank-calendar

- Monetary policy decisions news and analysis articles – Central Banking. (2024, January 11). Central Banking. https://www.centralbanking.com/central-banks/monetary-policy/monetary-policy-decisions

- Meeting calendars and information, Federal Reserve https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm

No Comments