The Rise of New Era Generative AI-Driven Investment Banking

Dr Farhad Reyazat- London School of Banking & Finance

6th March2024

Citation: Reyazat, F. (2024, March 6). The rise of new era generative AI-Driven investment banking. Dr. Farhad Reyazat. https://www.reyazat.com/2024/03/06/the-rise-of-new-era-generative-ai-driven-investment-bankers/

In the dynamic world of investment banking, where innovation is imperative, Generative AI—a fascinating facet of artificial intelligence—is making waves. Let’s embark on a journey to explore the potential and challenges that Generative AI brings to investment banking. Whether you’re a seasoned financial professional or a curious observer, this article will serve as your gateway to understanding how AI shapes the future of finance.

Wall Street’s embrace of artificial intelligence (AI) is evident through the strategic moves of several leading banks and financial institutions, which aim to harness AI’s power for improved efficiency, decision-making, and customer service.

JPMorgan Chase & Co. stands at the forefront, with a substantial recruitment drive for AI talent. In just three months, it advertised 3,651 AI-related roles, nearly double the number of its closest competitors, Citigroup Inc. and Deutsche Bank. This surge in AI talent acquisition underlines a broader trend within the financial sector, where institutions are keen to explore and leverage AI capabilities to enhance their operations and service offerings.

The interest in AI technologies, particularly since the release of OpenAI’s ChatGPT, has significantly influenced banking executives’ perspectives on AI’s potential to transform business processes. Financial entities are experimenting with AI for various applications, including risk assessment, investment strategies, and enhancing customer interactions.

Deutsche Bank is aggressively experimenting with AI capabilities to transform its business. The bank aims to double its AI employee base, but challenges include regulation, talent acquisition, and scaling costs. Deutsche Bank employs deep learning algorithms to assess client investments and recommend suitable financial products, blending AI insights with human judgment for investment advice.

Similarly, JPMorgan has sought to patent an AI-driven service akin to ChatGPT to aid investors in selecting equities. JPMorgan CEO Jamie Dimon expressed confidence that banks can win the AI battle against fintech. He outlined a vision for leveraging data to secure victory in this race.

At Goldman Sachs, the chief investment officer and head of machine learning quants believe we are at an inflection point with AI. They are experimenting with large language models (LLMs), similar to ChatGPT, which could transform how Wall Street conducts business.

Morgan Stanley has allowed its business units to explore the use of open-source large language models for testing, including developing a model to analyze Federal Reserve communications to gauge monetary policy directions.

Hedge funds are also hiring AI experts. These executives are crucial in setting AI agendas, sharing research progress, and advocating for technology adoption within their firms.

On the other hand, companies outside the financial sector, like Cushman & Wakefield in commercial real estate, are also harnessing AI for data analysis, improving client services, and ensuring data safety and integration. Their approach emphasizes the importance of transparency and cybersecurity in AI applications.

LinkedIn has integrated AI across its platform to enhance user experiences, from profile writing assistance to job search and recruitment processes. This initiative reflects a broader commitment to leveraging AI responsibly, with an eye toward ethical considerations and equity.

Corporate and Investment Banking

The McKinsey report identifies the evolving dynamics of the Corporate and Investment Banking (CIB) market, particularly emphasizing the challenge posed by nonbank competitors. Historically, these entities have operated in domains closely related to wholesale banking, such as private equity and retail payments. Over recent years, they’ve successfully expanded their offerings, now directly competing with CIBs for the same customer segments.

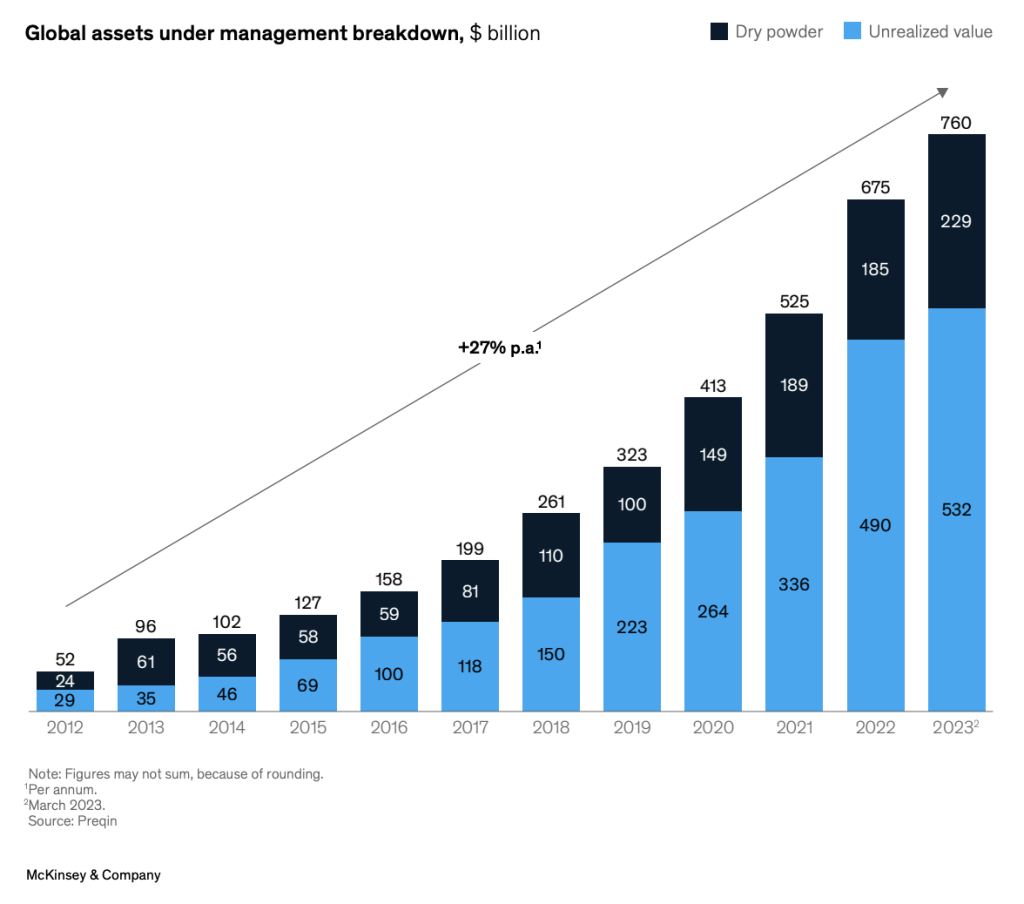

A significant area of disruption highlighted in the report is leveraged lending, where direct lenders have experienced rapid growth. As of March 2023, the global assets under management (AUM) for direct lending stood at approximately $760 billion, reflecting a robust annual growth rate of 27% since 2012. This momentum in direct lending is poised to persist, fueled by an abundance of private equity ‘dry powder’ and a move towards more significant transactions and diverse debt instruments.

To navigate the challenges of direct lenders’ ascent, McKinsey suggests that CIB firms reconsider their traditional lending strategies. This might involve exploring off-balance-sheet partnerships and fund arrangements while maintaining a vigilant approach to risk management. The concerns around direct lending asset performance are not trivial; they include potential impacts from rising interest rates, economic downturns, the scarcity of performance data during recessions, and increased regulatory oversight.

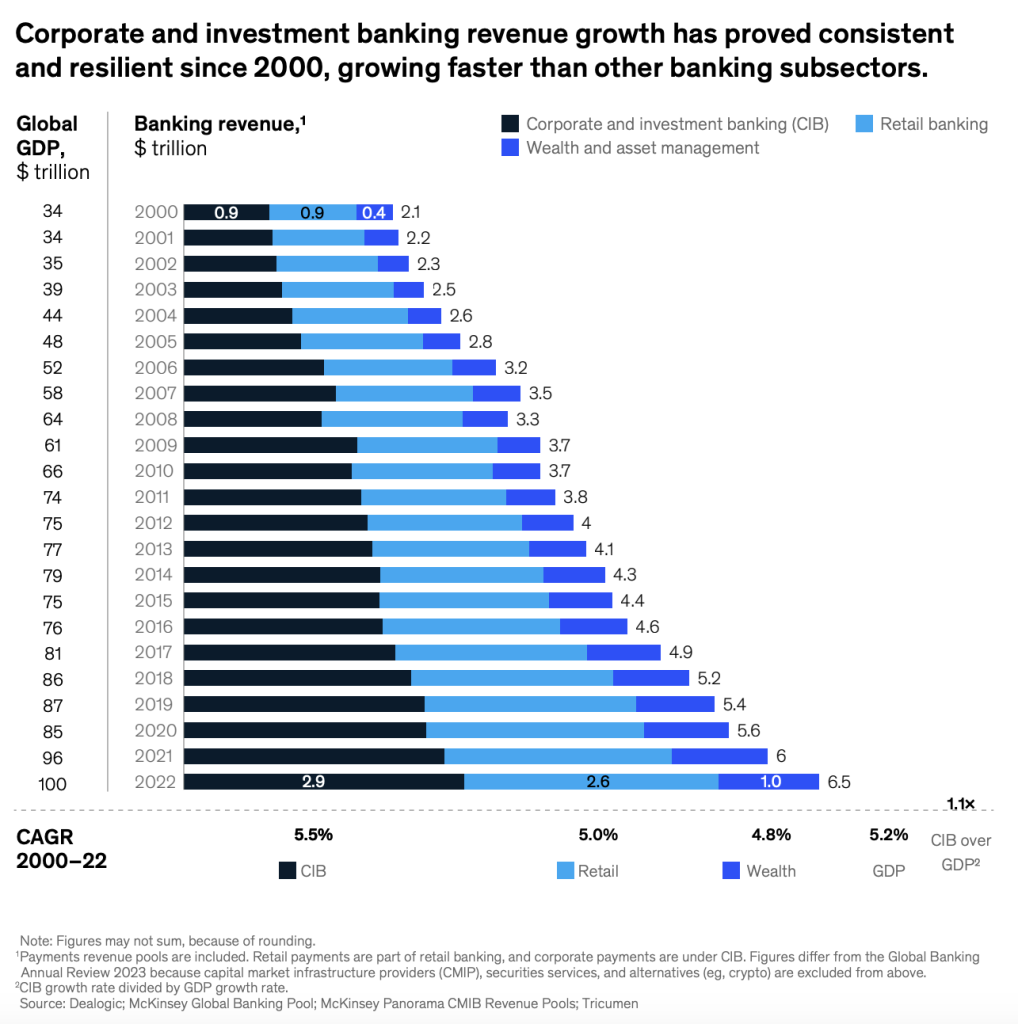

Despite facing numerous hurdles over recent years, the Corporate and Investment Banking (CIB) sector has demonstrated remarkable resilience and growth. In 2022, the industry reported revenues of $2.9 trillion, constituting 44% of the total global banking revenue, with an impressive annual growth rate exceeding 5% since 2020.

Over 80% of CIB income was derived from commercial lending and cash management services, underscoring the sector’s integral role in supporting the real economy. On the other hand, revenue from more intricate and less predictable areas, such as specialized lending, investment banking, and sales and trading, made up less than 20% of the total CIB revenue. This distribution highlights the foundational importance of traditional banking services within the CIB landscape despite the allure of higher-risk, higher-reward activities.

The McKinsey report discusses significant Corporate and Investment Banking (CIB) sector shifts, focusing on digitalization, generative AI, and new market structures as fundamental transformative forces. Generative AI is spotlighted for its potential to boost core CIB activities’ productivity by 30% to 90%, potentially increasing CIB operating profits by about 10% long-term. The report also notes the challenge from nonbanks, particularly in leveraged lending, where direct lenders have seen substantial growth, and the emergence of digital assets through tokenization, offering numerous benefits like 24/7 operations and instantaneous settlement.

Investment banks leverage artificial intelligence (AI) to enhance operations, reduce costs, and improve client services across various applications.

Deloitte’s insights on the transformative potential of generative AI in the financial industry are significant. According to their analysis, the top 14 global investment banks stand to gain substantial benefits from adopting AI technologies, particularly in their front-office operations.

The key points:

- Productivity Boost: By leveraging generative AI, these banks could enhance their front-office productivity by an impressive 27% to 35%. This increase in efficiency would have a direct impact on their overall performance.

- Revenue Impact: The projected boost in productivity translates to substantial revenue gains. Deloitte estimates that each front-office employee could contribute an additional $3.5 million in revenue by 2026. This revenue uplift is a testament to the transformative power of AI when applied strategically.

- Strategic Implementation: Investment banks must implement AI solutions to achieve these gains. This involves integrating AI into their existing workflows, optimizing processes, and leveraging data-driven insights.

In summary, Deloitte’s findings underscore the immense potential of generative AI in revolutionizing the financial sector, leading to increased productivity, revenue growth, and competitive advantage.

McKinsey’s analysis supports the profound impact of generative AI across corporate and investment banking, suggesting that productivity improvements could range from 30% to 90% in core activities, potentially adding 9% to 15% to CIB operating profits. Applications of generative AI in investment banking are vast, from new product development and customer operations to marketing and sales. They offer tools for code development, automate manual tasks, and significantly reduce the time for producing financial, ESG, and audit reports.

Several practical examples illustrate how investment banks are applying AI in their operations:

Man Group has partnered with Oxford University to establish the Oxford-Man Institute (OMI) to leverage AI in quantitative finance, showing a positive performance trend over recent years.

BNP Paribas Securities Services introduced Smart Chaser, a trade matching tool that uses predictive analysis to automate trade processing services. It claims to improve the efficiency of trade execution.

ING launched Katana, a tool designed to help bond traders make better and faster pricing decisions through predictive analytics. This has enabled traders to quote prices faster for 90% of trades and enhance pricing accuracy.

These examples underscore the investment banking sector’s commitment to incorporating AI into their workflows, driving innovation and efficiency. The benefits of AI in investment banking are clear. From boosting productivity and improving decision-making processes to enabling faster and more accurate services, AI technologies are set to redefine the investment banking landscape in the coming years.

Opportunities Unveiled by Generative AI

- Enhanced Data Analysis:

Generative AI empowers investment professionals to process and analyze vast amounts of financial data with unprecedented speed and precision. Real-time analysis and data interpretation capabilities open new avenues for deriving actionable insights from complex datasets.

Simplified data-driven decision-making becomes possible, enhancing overall efficiency in investment banking.

2. Algorithmic Trading:

Investment banks can leverage Generative AI to develop sophisticated algorithmic trading strategies. These adaptive strategies respond to market changes and potentially increase profitability while reducing risks.

The agility and adaptability of AI-powered algorithms create opportunities for investment banks to thrive in highly competitive financial markets.

3. Customer Engagement:

Generative AI can elevate customer engagement by enabling the creation of chatbots and virtual assistants. These AI-driven assistants offer highly personalized recommendations and assistance.

Improved customer experiences foster client loyalty, allowing investment banks to build stronger and enduring relationships.

4. Proactive Risk Management:

Generative AI models predict potential market risks and vulnerabilities. Investment banks can develop proactive risk management strategies to safeguard their investments and maintain a robust risk posture.

Anticipating and mitigating risks using predictive models preserves the integrity of investment portfolios.

The Challenges of Implementing Generative AI

Implementing Generative AI in investment banking presents challenges:

- Complex Regulatory Landscapes: Navigating regulatory requirements is crucial. Compliance with industry-specific legal norms ensures responsible AI deployment.

- Data Privacy and Security: Protecting sensitive financial data is paramount. Investment banks must ensure robust security measures to prevent breaches.

- Ethical Considerations: Addressing ethical concerns about AI decision-making and transparency is essential. Striking the right balance between innovation and ethical practices is a challenge.

In summary, Integrating Generative AI in investment banking heralds a future where data-driven decision-making and algorithmic trading become the norm, significantly enhancing efficiency and customer engagement while introducing complex challenges such as regulatory compliance and data security. The collaboration between traditional banking giants and technological innovations, as exemplified by partnerships and the development of tools like Smart Chaser and Katana, underscores a pivotal shift towards a more agile and insights-driven industry. Overcoming these hurdles will require a concerted effort to ensure ethical practices, safeguard data privacy, and navigate the evolving regulatory landscape, maintaining a delicate balance between innovation and responsibility.

Sources:

- From Goldman to Bridgewater, here’s everything we know about how Wall Street embraces AI | Business Insider México | Noticias pensadas para ti. (2023, December 28). Business Insider México | Noticias Pensadas Para Ti. https://businessinsider.mx/wall-street-goldman-jpmorgan-bridgewater-using-ai-2023-12/

- Cingari, P. (2023, March 27). Wall Street loves AI: Goldman expects a shocking $7 trillion boost in global GDP and raises targets for MSFT, CRM, and ADBE. markets.businessinsider.com. https://markets.businessinsider.com/news/stocks/wall-street-loves-ai-goldman-expects-a-shocking-7-trillion-boost-in-global-gdp-and-raises-targets-for-msft-crm-adbe-1032194724

- As generative AI shifts business strategy, the new ServiceNow & Deloitte Outlook outlines key actions for business leaders to drive value. (2024, March 4.). Deloitte United States. https://www2.deloitte.com/us/en/pages/about-deloitte/articles/press-releases/servicenow-and-deloitte-outlook-outlines-key-actions-for-business-leaders-to-drive-value.html

- Fintechnews Switzerland. (2024, January 22). McKinsey: Digitalization, generative AI, new market structures among key changes shaping investment banking – Fintech Schweiz Digital Finance News – FintechNewsCH. Fintech Schweiz Digital Finance News – FintechNewsCH. https://fintechnews.ch/digital-transformation/mckinsey-digitalization-generative-ai-new-market-structures-among-key-changes-shaping-investment-banking/68974/#:~:text=McKinsey%20estimates%20that%20generative%20AI%20could%20improve%20productivity,of%20CIB%20operating%20profits%20in%20the%20long%20run.

- Finextra. (2024, February 6). The Rise of AI in Investment Strategies in 2024: how AI revolutionizes investment strategies. Finextra Research. https://www.finextra.com/blogposting/25625/the-rise-of-ai-in-investment-strategies-in-2024-how-ai-revolutionizing-investment-strategies

- The rise of AI and what it means for business. (2024, February 22). RSM Global. https://www.rsm.global/insights/rise-ai-and-what-it-means-business

- Gopalakrishnan, S., Srinivas, V., & Chauhan, A. (2023, October 3). Unleashing a new era of productivity in investment banking through the power of generative AI. Deloitte Insights. https://www2.deloitte.com/us/en/insights/industry/financial-services/financial-services-industry-predictions/2023/generative-ai-in-investment-banking.html

- Palmer, J. (2023, June 22). Generative AI in banking: reality, hype, what’s next, and how to prepare. Cryptopolitan. https://www.cryptopolitan.com/generative-ai-in-banking/

- Team, S.(2023, November 7). The Future of Generative AI in Investment Banking | qbotica. qBotica | Intelligent Automation for your Enterprise | Featured UiPath Platinum Partner. https://qbotica.com/banking/the-future-of-generative-ai-in-investment-banking-opportunities-and-challenges/

- Benefits and use cases of generative AI in banking | Uptech. (2023, September 28). https://www.uptech.team/blog/generative-ai-in-banking

- Giovine, C., Lerner, L., Moon, J., & Schorsch, S. (2023, September 25). I’ve been there, doing that: How corporate and investment banks are tackling gen AI. McKinsey & Company. https://www.mckinsey.com/industries/financial-services/our-insights/been-there-doing-that-how-corporate-and-investment-banks-are-tackling-gen-ai

2 replies on “The Rise of New Era Generative AI-Driven Investment Banking”

Thank you Dr Reyazat

very informative