Fintech, Shaping the Future of Banking

Dr Farhad Reyazat – London School of Banking & Finance

October 2023

Fintech, a blend of “financial technology,” is revolutionising how we interact with financial services, propelling the banking sector into a digital future. This introductory overview explores the essence of fintech, its transformative role in modern banking, and the core themes that will be discussed throughout the article. By integrating cutting-edge technology with traditional financial practices, fintech offers innovative solutions that enhance accessibility, efficiency, and the overall customer experience. As we delve into this topic, we’ll uncover the evolution, current dynamics, and prospects of fintech in reshaping the banking and finance landscape.

In the past two decades, fintech has emerged as a transformative force in the financial services industry, marked by a series of innovations that have redefined traditional banking practices. Despite experiencing a significant market valuation drop in 2022, the sector is poised for a rebound, driven by enduring growth fundamentals. The financial services industry, although vast and profitable, faces challenges in innovation and customer experience, with fintech positioned to address these gaps. Currently, fintech’s global revenue share is 2%, with projections to surge to $1.5 trillion by 2030, capturing nearly a quarter of all banking valuations globally. The Asia-Pacific region, particularly emerging economies like China, India, and Southeast Asia, is expected to lead this growth, benefiting from fintech’s role in expanding financial inclusion. North America remains a pivotal innovation center, with Europe, Latin America, and Africa also showing strong growth potential. The focus is shifting towards B2B and B2B2X models, targeting the unmet credit needs of SMEs estimated at $5 trillion annually. The report, co-authored by BCG and QED Investors, delves into fintech’s global landscape, analysing trends, challenges, and opportunities across various sectors, and highlights the importance of regulatory adaptation and technological innovation in shaping the sector’s future.

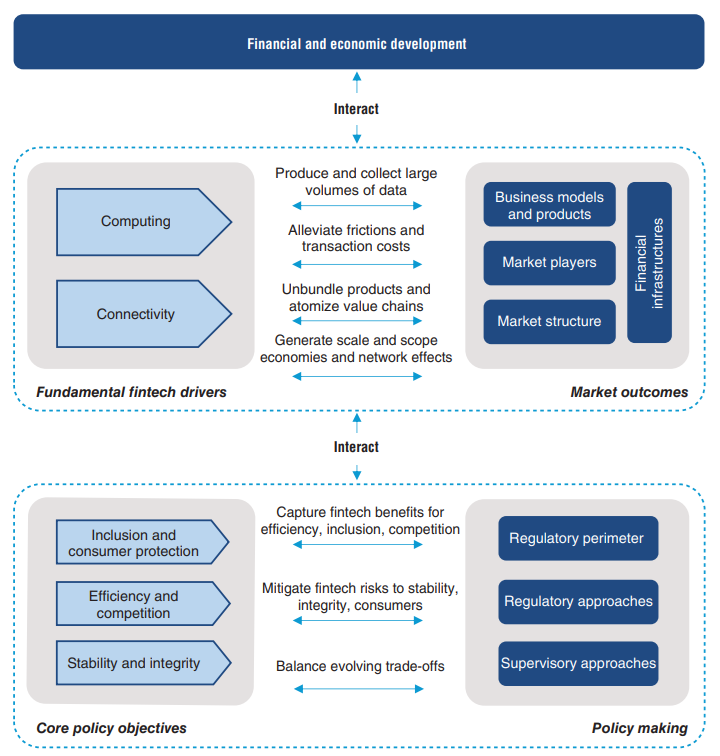

Chart: Conceptual framework of fintech development, market outcomes, and policymaking

Source: Fintech and future of finance, World Bank Group (2023)

The above chart is a conceptual framework that outlines the interplay between fintech development, market outcomes, and policymaking. Here’s an explanation of each component:

1. Fundamental fintech drivers: These foundational elements propel fintech forward. ‘Computing’ refers to the computational power that enables complex financial algorithms and data processing. ‘Connectivity’ relates to the networks that allow for the transmission of financial data and connect various stakeholders.

2. Financial and economic development: This refers to the broader context in which fintech operates. The development of fintech is influenced by, and in turn influences, the overall financial and economic development.

3. Market outcomes: This part in chart covers the results of fintech’s influence on the market. It encompasses changes in business models and products, the entrance of new market players, and shifts in the market structure.

4. Interactions: There is a dynamic interaction between the fundamental drivers of fintech and market outcomes and between market outcomes and policy-making. This suggests that changes in one area will affect the others.

5. Core policy objectives: These objectives are the goals that policymakers aim to achieve while regulating and shaping the fintech landscape. They focus on ensuring that fintech development leads to benefits such as increased efficiency, inclusion, and competition, while also maintaining stability and integrity within the financial system.

6. Policymaking: This involves setting the regulatory perimeter (defining what is regulated), determining regulatory approaches (how regulation is implemented), and supervisory approaches (how compliance is monitored). Policymakers need to capture the benefits of fintech while mitigating associated risks.

7. Balance evolving trade-offs: As fintech evolves, it presents new benefits and risks. Policymakers must balance these trade-offs to ensure that fintech development aligns with core policy objectives.

The framework presents a complex system where technological advancements in fintech drive market changes, which in turn inform policy decisions. These policies aim to harness fintech’s potential while safeguarding against potential downsides, creating a feedback loop that influences financial and economic development.

Fintech’s Meteoric Rise: Reshaping Global Banking and Finance

The landscape of global finance is undergoing a profound transformation, powered by the unstoppable march of fintech. Statistics from the World Bank’s Global Findex survey reveal that mobile money operators added more than twice as many accounts as banks in Sub-Saharan Africa from 2014 to 2017, positioning themselves as the vanguards of increased financial access. This is but a glimpse into fintech’s expansive impact on financial inclusion and the democratization of finance.

As digital transformation becomes a strategic priority for financial institutions, with 92% of organizations surveyed by the World Bank aligning it with their board-level goals, fintech is no longer a fringe element but a core strategic directive. This strategic shift is underscored by the value of mobile money transactions, which speaks volumes about the sector’s explosive growth, although specific figures are not provided in the reference.

The financial thrust behind fintech innovation is equally staggering. The total value of investments into fintech companies worldwide increased drastically between 2010 and 2019, when it reached 216.8 billion U.S. dollars. In 2020, however, fintech companies saw investments decrease notably, dropping below 140 billion U.S. dollars. Investment value increased again in 2021 up to more than 247 billion U.S. dollars. 2022, however, was another slow year for fintech, as the value of investments decreased notably, although remained well above the value measured in 2020. The downward investment trend continued in the first half of 2023, when global funding value stood at 52.4 billion U.S. dollars. This influx of capital underscores the market’s confidence in fintech as a game-changer for the financial services industry.

Fintech’s inroads into credit markets are particularly noteworthy. Big Tech credit and fintech have carved out a notable share of the total credit stock, reflecting the growing importance of alternative credit providers in the global finance ecosystem. Although the data for 2018 indicates that this was less than 2% in major fintech markets, the presence of such players disrupts traditional banking models and offers a glimpse into a future where credit is increasingly facilitated by non-traditional entities.

The cumulative effect of these investments over the past decade reveals the sector’s upward trajectory. From a modest start, global fintech investments have surged, peaking at $215.4 billion, as illustrated in the report’s historical investment data. This growth narrative is not just a story of numbers; it’s a testament to the sector’s vibrant innovation and its expanding role in shaping the future of banking and finance.

Fintech stands at the forefront of a financial revolution, one that promises to redefine banking as we know it. Its ascent is built on a foundation of strategic investment, technological innovation, and a relentless drive towards financial inclusion. As we continue to witness fintech’s expansion, one thing is clear: the future of finance is digital, decentralized, and inclusive, heralding a new age for consumers and businesses alike across the globe.

Future of Banking

The future of banking is being sculpted by fintech, a synergetic blend of financial services and technology. Fintech’s impact is multifaceted, with implications for customer experience, operational models, and the competitive landscape of the financial sector. Here’s how fintech is set to shape the banking industry in the future:

1. Customer Experience: Fintech has already shifted banking from traditional branches to digital platforms, offering a more convenient, personalized, and accessible service. The use of AI for personalized financial advice, blockchain for secure and transparent transactions, and the Internet of Things (IoT) for enhanced user experiences are just the beginning. Future banking will likely be characterized by seamless, omni-channel experiences that are integrated into customers’ daily lives.

2. Operational Efficiency: Through automation and advanced data analytics, fintech enables banks to streamline their operations, reduce costs, and improve accuracy in risk assessment. The future will see further automation, not just in back-office operations but in customer-facing processes as well, making banking faster and more cost-effective.

3. New Products and Services: Fintech has led to the creation of innovative financial products such as peer-to-peer (P2P) lending, crowdfunding, and cryptocurrency-related services. Looking ahead, we can expect more such innovations, including more sophisticated digital assets and investment platforms that cater to the needs of different market segments.

4. Financial Inclusion: Fintech has made banking services more accessible to underserved populations, particularly in developing countries. Mobile banking and digital wallets have brought financial services to those without access to traditional banking. This trend will likely continue, further bridging the gap in financial inclusion globally.

5. Regulatory Environment: As fintech continues to evolve, so too will the regulatory landscape. Regulations will need to balance the promotion of innovation with the protection of consumers and the integrity of the financial system. Regulatory technology (RegTech) will play a critical role in ensuring compliance and monitoring risks in real-time.

6. Competition and Collaboration: Fintech startups have introduced a level of competition that has forced traditional banks to innovate. The future will likely see an increase in partnerships between banks and fintech companies, combining the agility of fintech with the scale and trust of traditional banking.

7. Decentralization of Financial Services: The advent of blockchain technology and decentralized finance (DeFi) platforms challenges the centralized model of traditional banking. In the future, we may see a more decentralized financial ecosystem where transactions and services are provided on distributed networks, reducing the reliance on central authorities.

8. Cybersecurity: With the rise of digital banking, cybersecurity will become even more critical. Fintech will continue to develop sophisticated tools to protect against fraud and cyberattacks, ensuring the safety of digital financial transactions.

9. Sustainable Finance: Fintech enables the growth of sustainable finance by facilitating the flow of capital towards environmentally and socially responsible investments. The future of banking will likely include a stronger focus on ESG (environmental, social, and governance) criteria, driven by both consumer demand and fintech innovations.

Conclusion

In a world where technology and finance intertwine, fintech emerges as the guiding light, reshaping banking into a digital frontier. From its humble beginnings to its pivotal role today, fintech is poised to redefine the future of financial services. Imagine a world where banking is as seamless as browsing the web, financial advice is AI-driven, transactions are instant and secure, and opportunities abound for all. Fintech is ushering in this era—an era of financial empowerment, innovation, and global interconnectedness.

Fintech’s journey is far from over; it’s accelerating, driven by investments and a commitment to an inclusive and efficient financial ecosystem. The future of banking, shaped by fintech, promises prosperity, equity, and unwavering financial integrity.

The last word Fintech is not just a passing trend; it is a powerful catalyst for change in the banking sector. By driving innovation, inclusivity, and efficiency, fintech is poised to redefine the future of banking, creating a more resilient, customer-centric, and accessible financial ecosystem for all.

References

1. Demirgüç-Kunt, A., Klapper, L., Singer, D., Ansar, S., & Hess, J. (2022). _The Global Findex Database 2021: Financial Inclusion, Digital Payments, and Resilience in the Age of COVID-19._ World Bank.

2. Feyen, E., Natarajan, H., & Saal, M. (2023). _Fintech and Future of Finance._ World Bank Group.

3. Feyen, E., Natarajan, H., & Saal, M. (2023). _Fintech Market Participants Survey._ World Bank Group.

4. Statista. (2023). _Value of Fintech Investment Worldwide from 2010 to 2023.

5. World Bank Group. (2023). _Conceptual Framework for Fintech: Interactions Between Market Outcomes and Policymaking.

6. McKinsey & Company. (2023). _Global Banking Annual Review.

7. Boston Consulting Group (BCG) & QED Investors. (2023). _Fintech’s Growing Impact on Global Banking.

One reply on “Fintech, Shaping the Future of Banking”

The Real Person!

Author Biohacker acts as a real person and passed all tests against spambots. Anti-Spam by CleanTalk.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.