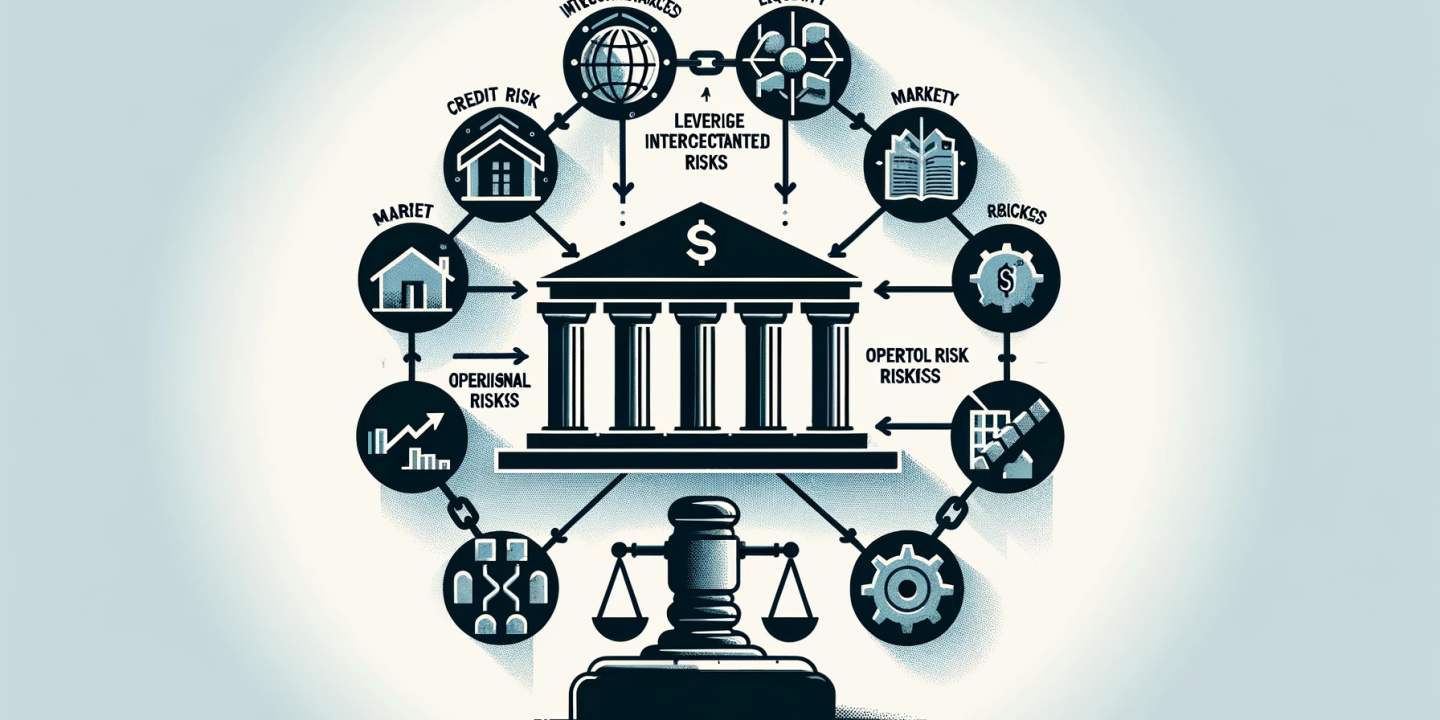

The financial crisis 2007-8 has underscored the need to go beyond the analysis of individual institutions’ soundness and assess whether the linkages across institutions may have systemic implications. The undeniable need to prevent such a crises in the future as well as to assess previous errors by way of comprehensive compliance has made such an assessment absolutely imperative.

This paper explains the suitable analytical tool for assessing and monitoring systemic risk in EU banks which in turn enables us to visualise the relationship between the financial network topology and systemic risk. This paper aims to examine the structure of financial network at an individual country’s level using network formation theory and then illustrate the structure of this network. The concept of core-periphery network is empirically tested in the paper by using the probit regressions testing whether network position can be predicted by individual network variables. The same methodology as Craig & Von Peter used for perfect core periphery structure. (Craig & Von Peter, 2010). The results confirmed the previous finding in this fields (for example see (Farboodi., 2014)). It shows that interbank relations coming to a core-periphery structure where the fit with Betweeness is much better than the fit with cross border exposures. The model indicates that there is a small number of very interconnected banks that trade with many other banks and a large number of banks that trade with a small number of counterparties.

When we study the banking network, with a consideration of all the complexities of the financial structure, one key question is ‘how can we improve our understanding?’ One of the key goal of this paper is to map out the effect of cross-border bilateral exposures and their macroeconomics consequences, as well as evaluate the topology of network and its effect on shocks transmission.

The paper points out that (i) banking network coming into scale free structure ;(ii) interbank structure follow the core-periphery structure (iii) the composition of banks group within the core sector remains remarkably stable over time. (iv) among centrality measures the fit of Core with Betweeness is much better than others; (v) countries with shallow domestic financial markets and concentrated exposures to a few lenders are more prone to synchronized shifts in cross-border flows; (vi) the importance of heterogeneity in network structure and the role of concentration of counterparty exposures in explaining its systemic importance of a banking sector in the economy; (vii) American banks positions in the network changed from fragile section to important and fragile; and(viii)common factors (such as global risk aversion) increasingly drive global financial markets and tend to intensify abruptly during periods of stress, amplifying shock transmission.

This paper contributes to the existent literature by examining the structure of banking network and developing a framework that explains how interdependencies between banks at country level emerge endogenously by mapping out the banking network. Please see the full text on the following file.

25 replies on “Network Structure and Systemic Risk in European Banks- Insights from Network Science”

Can you write more about this topic in the future?

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for sharing — very helpful insights.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your article helped me a lot, is there any more related content? Thanks!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Do you have a newsletter? I’d love to subscribe.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your article helped me a lot, is there any more related content? Thanks!

Would love to hear your thoughts on a related topic.

Your article helped me a lot, is there any more related content? Thanks!

I followed your tips and I’m already seeing results.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you, your article surprised me, there is such an excellent point of view. Thank you for sharing, I learned a lot.

Helpful for both beginners and professionals — thank you.